PerpeTraders (PERP)

Token Description

PerpeTraders (PERP) is a unique token on the Solana blockchain. It is multifaceted, serving simultaneously as a stablecoin, security token, utility token, and tokenized stock. This exclusive token is notable for its limited maximum supply of only 100, and it maintains precision to two decimal places. Launched in early 2022, PerpeTraders has established a strong market presence through its stable liquidity pool, making it a seasoned player in its field. Initially created for the legacy community-maintained Solana token registry, which has since reached its End of Life, it is an OG in the Solana token ecosystem.

Solana Token List

{

"chainId": 101,

"address": "EBQ6gWBQNxA2zB4twR5GWP6CkeAhqZZZeDgeP7BTtdM3",

"symbol": "PERP",

"name": "PerpeTraders",

"decimals": 2,

"logoURI": "https://raw.githubusercontent.com/solana-labs/token-list/main/assets/mainnet/EBQ6gWBQNxA2zB4twR5GWP6CkeAhqZZZeDgeP7BTtdM3/logo.jpg",

"tags": [

"stablecoin",

"security-token",

"utility-token",

"tokenized-stock"

]

},

Jupiter Token Strict List

{

"address": "EBQ6gWBQNxA2zB4twR5GWP6CkeAhqZZZeDgeP7BTtdM3",

"chainId": 101,

"decimals": 2,

"name": "PerpeTraders",

"symbol": "PERP",

"logoURI": "https://raw.githubusercontent.com/solana-labs/token-list/main/assets/mainnet/EBQ6gWBQNxA2zB4twR5GWP6CkeAhqZZZeDgeP7BTtdM3/logo.jpg",

"tags": [

"old-registry"

]

},

Benefits and Considerations

The Solana token, PerpeTraders (denoted as PERP), has a fixed supply of 100 and includes two decimal places for precision. Here are several key benefits and considerations of this setup:

A Commitment to Original Design: Being created prior to the adoption of the Metaplex Token Standard in June 2022 and opting not to transition to the new Solana system, the token avoids adopting features that might allow for changes in supply. The original design of $PERP included a hard cap on token supply, and staying on the legacy system ensures adherence to this initial design and economic model.

Scarcity and value preservation: A fixed supply of only 100 tokens, with 2 decimals for granularity, inherently limits the number of tokens available. This scarcity can lead to a higher value per token, assuming there is sufficient demand. Scarcity is often used as a mechanism to preserve or increase value over time.

Price stability with liquidity pool: A liquidity pool paired with a stable and popular cryptocurrency like SOL can provide more liquidity and potentially more stability to the token's price. This is because the pool facilitates easier trading and exchange, allowing for smoother price discovery.

Limited inflation risk: With a fixed supply, there is no risk of inflation due to the creation of new tokens. This is attractive to owners who are concerned about the dilution of value.

Potential for high liquidity: Given the limited supply, these tokens might have high liquidity, making it easier for holders to buy or sell without causing major price fluctuations.

Speculative interest: Due to the limited supply and liquidity, these tokens might attract speculative interest. Traders might see an opportunity for significant price movements, given the right market conditions.

Community and exclusivity: A small total supply can foster a sense of exclusivity and community among holders, which can be beneficial for building a dedicated user base or for certain types of Frenz that benefit from having a smaller, more engaged group of participants.

Liquidity Provider

Token Locking Incident

Liquidity Provider Token Locking

Token Lock Created: 2024-01-02 23:42

Token Locker: Sollama

Locked Asset: 5WB4...BXRb

Locked Amount: 50

Percent of LP Locked: 68.49 %

Locking Transaction: Transaction Details

Purpose of Locking Tokens: Locking liquidity provider tokens is a commitment to the stability and longevity of the token. It prevents the abrupt withdrawal of these tokens, which could destabilize the liquidity pool and, consequently, the token's price. This lock-up aimed to instill confidence in potential Frenz about the long-term commitment and seriousness of PERP.

1st Malicious Action

Date/Time: 01-13-2024 05:31:22

Malicious Account: yhXq...e7Di

Malicious Transaction: Transaction Details

Description of Malicious Action: The malicious actor moved the liquidity provider tokens, which had been locked by Sollama’s Solana program, to a different account.

2nd Malicious Action

Date/Time: 01-13-2024 05:32:04

Malicious Account: yhXq...e7Di

Malicious Transaction: Transaction Details

Description of Malicious Action: The malicious actor utilized the liquidity provider token to withdraw liquidity from the LP, consequently receiving 46.26 PERP and 55.75 SOL.

3rd Malicious Action

Date/Time: 01-13-2024 05:33:22

Malicious Account: yhXq...e7Di

Malicious Transaction: Transaction Details

Description of Malicious Action: The malicious actor swapped 46.26 PERP for SOL, receiving 17.55 SOL in the process.

Funds Affected: Founder's personal contribution to the PERP Liquidity Pool (LP).

Liquidity Provider

Token Burning

Purpose of Token Burn: Burning liquidity provider tokens demonstrates a far greater commitment than simply locking them, as this action permanently reduces the token's supply, emphasizing a strong dedication to its stability and value. Unlike the temporary measure of locking, burning ensures these tokens can never be used to withdraw liquidity from the Liquidity Pool (LP), offering a more definitive safeguard.

1st Liquidity Provider

Token Burn Event

Date/Time: 2024-02-03 20:03 UTC

Liquidity Provider Token: 5WB4...BXRb

Total Quantity Burned: 9.99

Transaction Signature: 45Y7...SqWK

2nd Liquidity Provider

Token Burn Event

Date/Time: 2024-02-04 22:29 UTC

Liquidity Provider Token: 5WB4...BXRb

Total Quantity Burned: 9.99

Transaction Signature: 2SEN...kqJy

3rd Liquidity Provider

Token Burn Event

Date/Time: 2024-12-23 04:32

Liquidity Provider Token: 5WB4...BXRb

Total Quantity Burned: 10.11

Transaction Signature: 4Rmd...7snQ

Continuous Liquidity

Enhancement Strategy

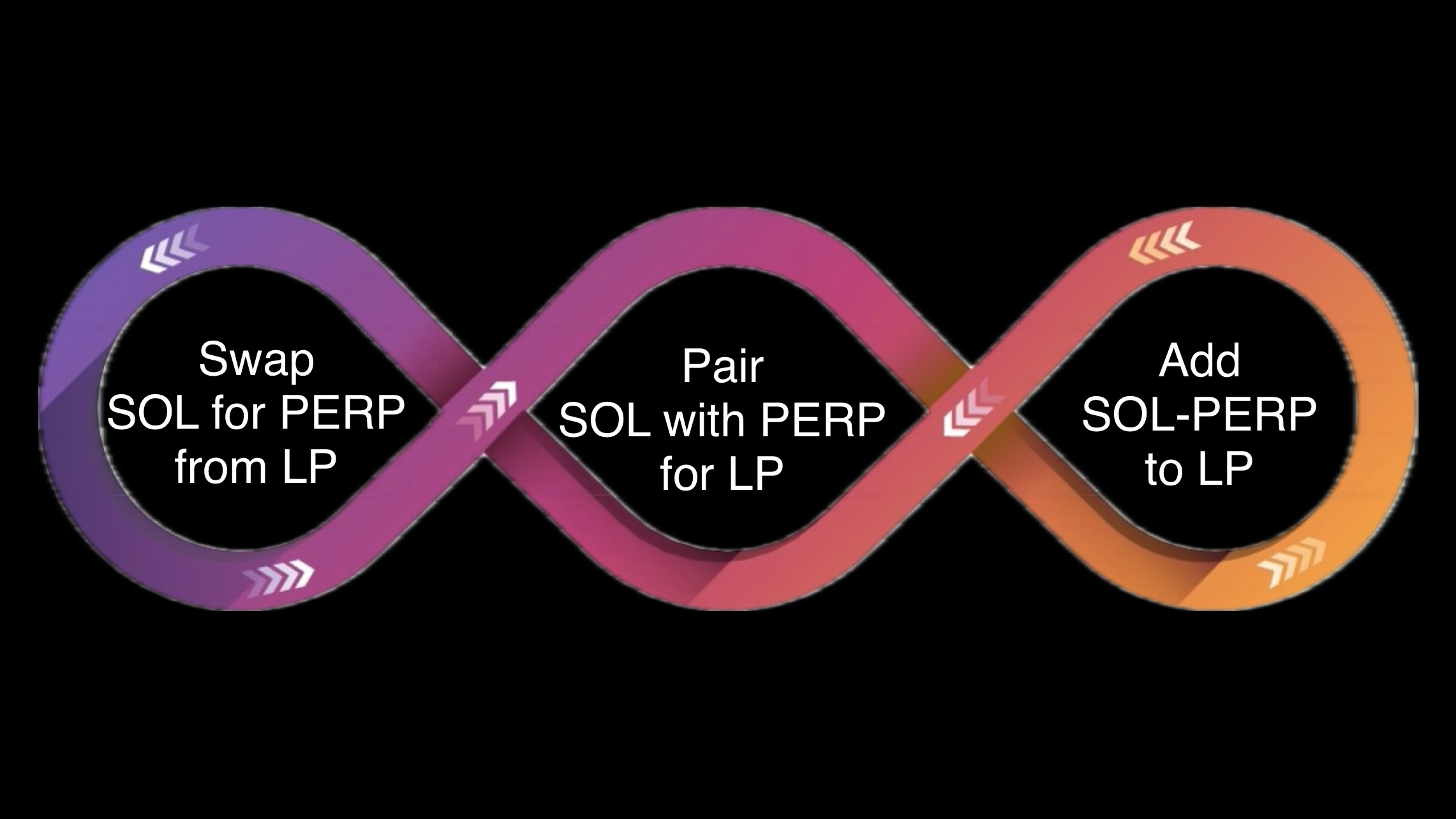

The diagram illustrates a three-part infinity loop, symbolizing the Continuous Liquidity Enhancement Strategy. Each segment of the gradient-shaded loop is interconnected, with chevron icons indicating the direction of process flow. This visual representation emphasizes the strategy's cyclical and unending nature.

The first segment of the loop depicts the exchange of Solana (SOL) for PerpeTraders (PERP). This process involves removing PERP from and introducing SOL to the Liquidity Pool (LP). Subsequently, the obtained PERP is paired with SOL, constituting the second stage. The final step entails reintegrating this SOL-PERP pair into the LP. The primary objective of these continuous steps is to systematically boost the pool's overall liquidity through a cycle of swapping and pairing.

Security

✅ NO | Mintable: Mint function enables contract owner to issue more tokens and cause the coin price to plummet. It is extremely risky. However if ownership is renounced, or is changed to a burn address, this function will be disabled.

✅ YES | Ownership Renounced: If token ownership is renounced, no one can execute functions such as mint more tokens.

White Paper

Wallet

To obtain PERP, you will need a Solana Program Library (SPL) wallet. This wallet is essential for storing your funds on the Solana blockchain and for interacting with various Solana Programs.

|

|

|---|

|

|

|---|

How to create a crypto wallet with Phantom

Acquire PERP

The Token Swap Program facilitates straightforward trading of token pairs without the need for a centralized limit order book (Solana Labs 2022). A swap feature enables the rapid exchange of two tokens, while a decentralized exchange (DEX) interface also supports more advanced trading options, including limit orders (Raydium 2022).

Token Address: EBQ6...tdM3

Liquidity Pool Address: 47Mj...ecky

Liquidity Provider Token Address: 5WB4...BXRb

Raydium’s Swap: PERP

Jupiter’s Swap: PERP

Dexlab's Limit Order: PERP

View PERP on DEXTools, the leading DeFi trading app with over 15 million monthly users. Built with the latest technology, DEXTools benefits from daily feedback from its extensive community.

View PERP on GeckoTerminal, a CoinGecko-developed decentralized exchange (DEX) tracker. This comprehensive platform enables monitoring of your PERP assets. It features a DeFi tracker for accessing prices, live charts, and detailed transaction data on DEXs. GeckoTerminal provides real-time trading information, covering individual pairs, exchanges, and chains. It offers insights into liquidity, transaction counts, and specifics of trading pairs.

Disclaimer

While these features present advantages, they also entail risks. A limited supply may cause price volatility in response to sudden demand shifts. Moreover, the liquidity pool, although it provides stability, raises concerns about the impact of liquidity withdrawal. As with any commitment, potential token holders should engage in comprehensive due diligence, weighing both the opportunities and risks involved.